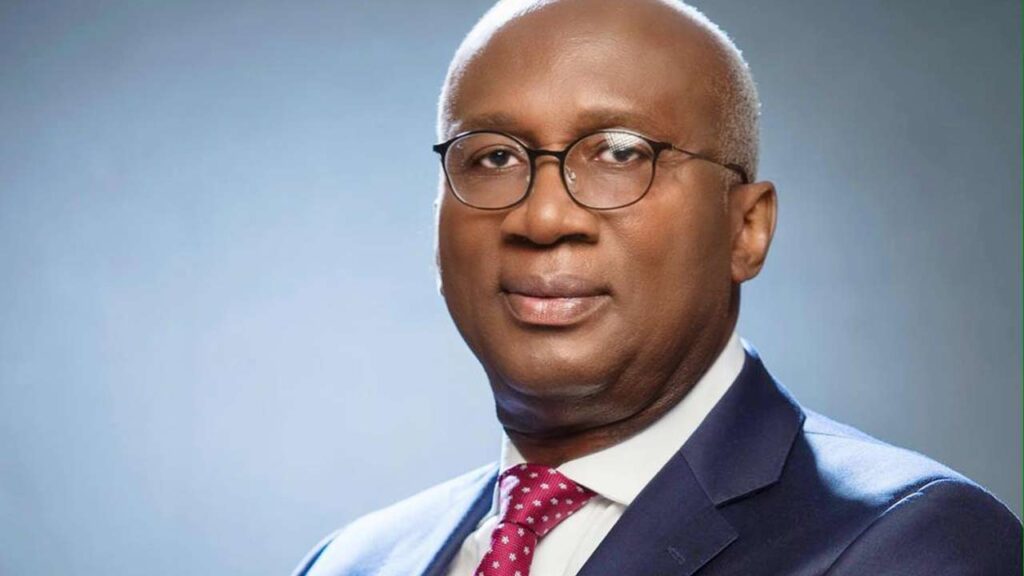

Abisoye Ajila, a seasoned financial services and technology leader with over 15 years of experience, sees technology as the key to unlocking the future of finance. Ajila’s background spans pensions, insurance, and asset management, and his expertise bridges the gap between traditional finance and the cutting edge of technological innovation.

The significance of his work and proficiency in financial services is underscored by the impact that technologies such as algorithmic investing intelligence have in combating investment fraud, enhancing the global competitiveness of the United States and Africa, fostering financial inclusion of the underserved population, and promoting socio-economic growth.

“Customer experience has become a strategic battleground,” says Ajila, referencing his dual degrees in Computer Science and Business Administration. “The ability to personalise service is what sets companies apart, and algorithmic investing intelligence is a powerful tool to achieve this.”

This technology leverages artificial intelligence (AI) and machine learning to create bespoke financial solutions for individual clients.

“A PwC report highlights the potential benefits of AI,” Ajila explains, “projecting gains of $3.7 trillion for North America and $1.2 trillion for Africa by 2030. From asset management to investment banking, financial institutions that embrace AI stand to reap significant rewards.”

Algorithmic investing empowers personalisation across multiple areas. Imagine:

- Tailored Financial Advice: AI analyses data to create investment plans that align with your unique goals and risk tolerance.

- Targeted Customer Engagement: No more irrelevant pitches. AI identifies your needs and preferences, ensuring you only receive information relevant to your financial journey.

- Enhanced Products and Pricing: Financial institutions can develop products and pricing models that cater to your specific financial profile.

- Optimised Investment Strategies: AI continuously monitors market trends and adjusts your portfolio accordingly.

- Improved Risk Management: AI proactively identifies and mitigates potential risks in your investments.

“Big data analytics and AI are the engines that drive this technology,” says Ajila. “By analysing vast sets of data, AI uncovers client behaviours, identifies trends, and recommends personalised investment strategies. This translates to faster, more accurate, and efficient service, while also improving market liquidity and scalability.”

But the benefits extend beyond just the bottom line.

“Real-time analysis and adaptation ensure regulatory compliance while reducing costs,” Ajila continues. “Ultimately, this leads to a dramatically improved customer experience.”

In today’s crowded financial marketplace, customer loyalty is hard-won.

“Customers are drawn to institutions that see them as partners,” observes Ajila. “They value companies that understand their journeys and adjust their offerings to meet their evolving needs. Personalisation, powered by data and analytics, is the key to building lasting customer loyalty and driving sustainable growth.”

Ajila’s experience spearheading business expansion and digital customer experience initiatives underscores his belief in the power of personalisation.

“Financial institutions need to make personalisation an absolute priority,” he concludes. “By strategically leveraging data and analytics, they can ensure they meet the ever-changing needs of their customers, fostering a loyal and engaged base. In the competitive landscape of tomorrow, this data-driven approach to personalisation will be the difference between success and failure.”