Worsening inflation has made property acquisition nearly impossible for average and middle-income earners in the country. But the emerging option of fractional ownership of properties is offering a leeway for many, VICTOR GBONEGUN reports.

Operatives are overcoming high entry barriers and financial constraints in real estate by embracing fractional investment, which is challenging the dynamics of traditional equity ownership and making property more accessible to lightweight investors.

The innovative approach enables investors to purchase a proportion or stake in high-value real estate assets. By gaining direct access to lucrative property deals on a fractional basis, investors can overcome capital limitations better and benefit from lucrative returns derived from direct property ownership.

Indeed, the primary obstacle for many aspiring real estate investors has always been the high property price. Fractionalisation addresses this issue by reducing the price of an asset, effectively increasing the pool of potential buyers. Under the scheme, each owner has a percentage of ownership and corresponding rights to use the property for a specific period and the model has become more popular in luxury properties, vacation homes, and commercial real estate.

The Guardian learnt that some of the benefits of the model are shared costs and expenses, flexibility in usage and management, income generation through rentals, and a high potential for diversification of investment portfolios.

It will be recalled that the Nigerian financial services sector recently adjusted its lending rates in response to the spike in the Monetary Policy Rate (MPR) to 26.25 per cent in May 2024.

Currently, about 25 out of 31 lending financial institutions offer maximum borrowing interest rates above the MPR to various sectors of the economy, while only a few banks give loans to some sectors at a rate below the benchmark interest rate. Besides, the persisting inflation saw rates soar to 33.95 per cent as of May, thus, forcing prices of construction materials to spiral.

Experts said real estate fractionalisation has the potential to positively influence the market by democratising access to investment opportunities, while the ability for ordinary people to invest in real estate without traditional financial constraints opens up a world of possibilities.

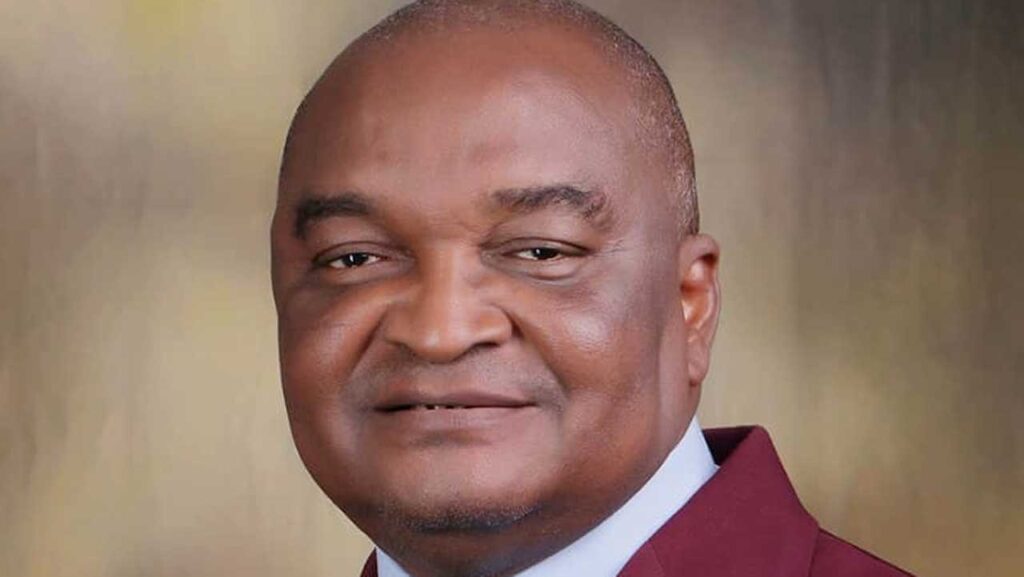

Former Chairman, Nigerian Institution of Estate Surveyors and Valuers, Lagos branch, ‘Dotun Bamigbola, emphasised that property fractionalisation is good for countries like Nigeria that are challenged by homeownership.

He pointed out that with the rising cost of construction, fractionalisation would provide more opportunities for home ownership within a shared system at a reduced cost to individuals or families.

He said: “It is a collaborative approach to property ownership using a special purpose vehicle (SPV) to legally own property by different interests/people. The attractions are reduced cost of ownership; access to use the unit of housing personally or make it an income; individual right of ownership and capacity to dispose unit individually.

“There may be clauses, which may create some restrictions in disposal in terms of management of the structure legally and operational. One of the demerits is that you don’t own the property wholly, as most people in this clime may prefer and your right may not be total, except within the entire system.

“Also, where there is a common management problem, a fractional owner cannot solely handle it in his/her way. The choice of solution has to be collective. Where a group of fractional owners wish to make a total disposal of the investment as a whole based on opportunities, if one fractional owner is not interested or has a price disagreement, the opportunity may be lost,” he explained.

The founder of Maihomm Real Estate Services, which specialises in fractional real estate management, Eni Eniola, said through the scheme, individuals could start on the property ladder on a fractional basis, receiving monthly rental income proportional to their ownership.

Investors, he said, could earn passive income in Foreign Exchange (FX) in addition to hedging against inflation, with an estimated 21 per cent per year in rental income from the co-owned property and recoup their initial investment with consistent cash flow in FX.

According to him, investors could also earn an average of four to six per cent yearly asset appreciation that is redeemable on the sale of the entire asset or the sale of their stake in the property. Investors in the scheme, he further said, are the legal beneficiaries of hard assets, which is vital for any strong investment portfolio strategy as property owners.

Immediate past chairman, Real Estate Developers Association of Nigeria (REDAN), South-West Zone, Mr Debo Adejana, said the model was bound to gain more traction going by the peculiarity of the Nigerian environment. He observed that fractionalisation is gaining more ground now and will continue to grow.

Essentially, he said, there is a need to develop a proper structure around it and tighten the regulation so that Nigerians don’t fall prey to dubious people.

“The self-help that people are resorting to is gradually being popularised. A lot of our banks, the foremost financial institutions, seem not to understand the real estate sector, are not interested or don’t have enough resources to actually fund real estate either from the supply or demand side. What then happens is that the people are left to self-help.

“So, it is the self-help initiatives of developers or people who need their transactions to be funded that have resorted to crowdfunding or fractionalisation. For instance, if I want to start a project, and I don’t have funding but realise that I can talk to about 100 people and my friends to contribute N100,000 each, which amounts N100 million to fund my project. If I present the case to them and they partner the project with me, I will fund my project based on a mutually agreed arrangement, and if I succeed with that, I’m bound to repeat the process until a time when I don’t need such funding again,” he said.

Adejana said when a developer goes to individuals, who contribute small amounts of money; they don’t have the power of control over such investment because the developer pools them together and if trust is abused their money will go down the drain.

“The Nigerian Security and Exchange Commission (SEC) needs to check such crowdfunding so that it’s not easily abused and can become the voice of those integral partners or providers of funds, who provided their tokens to aggregate into huge amounts,” he advised.